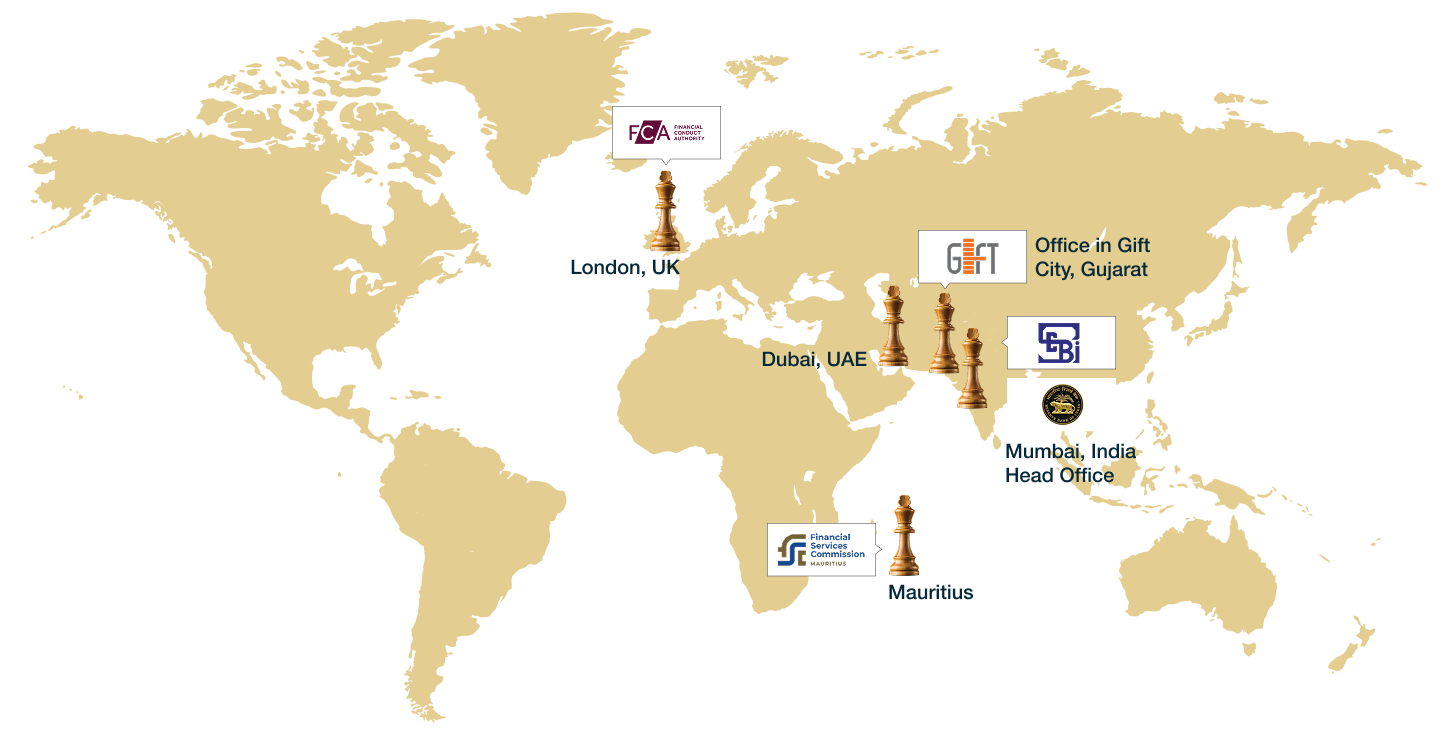

Abans Financial Services Ltd. (AFSL) is a diversified financial services institution, listed on the BSE and NSE, with operations across India, United Kingdom, Mauritius, Dubai and GIFT City. Since our incorporation in 2009, we have transitioned from a proprietary trading firm into a multi-asset, risk-managed platform offering investment, lending, and treasury solutions to institutional and high-net-worth clients globally.

Read More

From GIFT City to London and Mauritius, the Group is globally regulated. Our structures enable efficient access

to capital,

differentiated products, and cross-border investor participation.

Founder, Chairman and Managing Director

Whole-time Director and Chief Executive Officer

Whole-time Director and Chief Financial Officer

From Holding Company to High-Growth Financial Powerhouse

* CAGR - Three year period

Strategic Levers that Drive Long-term Value Creation

A differentiated platform across asset classes, investor needs, and

jurisdictions — built for scale, compliance, and performance.

| Offering | USP/Differentiation | FY 2024-25 Snapshot |

|---|---|---|

| Global Arbitrage Fund (GAF) | 8.2% USD CAGR, monthly liquidity, low leverage, global strategy |

$ 100 Million+ AUM – 80% offshore clients |

| PMS | Equity-focused, high-alpha strategies, SEBI-registered |

₹125 Crores+ AUM – 22%+ YoY growth |

| AIF (GIFT City) | Tax-efficient access, regulated by IFSCA |

Newly operational |

| Mauritius VCC | Multi-asset global structure with equity, debt, and commodity funds |

Abans Hedge Fund – Risk-adjusted global strategies Debt Fund – Yield-focused, structured portfolios |

| Offering | USP/Differentiation | FY 2024-25 Snapshot |

|---|---|---|

| Investment Banking & Structuring | Private placements, fund raising, bespoke structuring |

Launched FY 2024-25 |

| Offering | USP/Differentiation | FY 2024-25 Snapshot |

|---|---|---|

| Secured Term Loans |

Zero NPA, CRAR 24%, Risk-calibrated underwriting |

₹ 265 Crores book 0% Gross Non-Performing Assets |

| Trade Finance |

Physical + derivatives-backed structures |

Growing pipeline |

| Offering | USP/Differentiation | FY 2024-25 Snapshot |

|---|---|---|

| CASL (UK) |

Transitioning into transaction banking – FX, payments |

$ 40 Million plus transactions |

| Offering | USP/Differentiation | FY 2024-25 Snapshot |

|---|---|---|

| Treasury/Arbitrage Book |

Cross-market strategies across commodities, derivatives |

₹ 3,000 Crores+ in treasury revenue in FY 2024-25 |